The recent news concerning the impending acquisition of Warner Bros Discovery by Netflix has immediately generated a lot of clapback from a multitude of directions. Initially, I filed these reports away under “revisit later in case of fire” because news items like these usually spark a flurry of reactionary think-pieces and sensationalist doom-mongering coming from politicians, industry insiders, guilds, filmmakers and theatre owners, most likely because rage bait generates engagement and engagement translates to moolah.

My own initial thoughts were mostly devoted to commenting on what I saw as the most likely reason this acquisition was coming that nobody would ever list in a press release, which derives from a simple calculation that Netflix cannot grow forever in line with investor expectations as a business with its core in streaming, because all their competitors generate money elsewhere and use their streaming platforms for things like customer retention, IP protection, tax write-offs, etc. Therefore, expanding their pre-existing film production capacity and adding highly desirable properties to their portfolio would likely buy them time and build a platform to generate revenue beyond monthly subscriptions.

But I think I might have to refine my thinking here, especially having woken up to a nice email from the Netflix team informing me, their customer, about the incoming acquisition. And for those who have never worked at a publicly-listed corporation, any email from the leadership whose overarching message reads as “do not worry; nothing is changing” is, above all, a cause for worry. When execs try to sound reassuring, you know a bloodbath and an upheaval is coming and the question is no longer if changes will come, but when, followed by who and what is going to be affected by these changes that are “definitely” not coming “yet” because we are all “super happy” this is all happening anyway. The lady doth protest too much and all that.

Now, it is important to remember that the deal has only been announced and there’s a lot of due diligence to be sorted out in anticipation of its closure, but—again—anyone who’s ever worked at a company listed at the stock market will know that despite all the backlash and angry finger-wagging coming from senior politicians, this deal will likely come through. Nobody makes an announcement like this and then ends up surprised by an antitrust lawsuit or something to that effect. Netflix’s highly compensated legal teams have most certainly already looked into these scenarios and they have surmised it won’t be a big problem for them to overcome. Otherwise, such an announcement that always results in swings in the financial markets would not have been allowed.

So, does this deal spell the end of cinema as we know it? I don’t know. The Netflix leadership have come out and confirmed that no changes are planned to the release schedule and current slate at WB, which should really be translated as “we are not planning to do anything drastic immediately, but we are going to do it at some point and we need to figure out how best to navigate this landscape without looking like a bull in a china shop.” Commentators popped up and mused that cinemas might close because Netflix will eventually fold WB operations into their release strategy, which includes much shorter theatrical windows reserved only for productions with awards appeal.

And this might as well be what’s going to happen despite what my glass-half-full thinking would suggest. Optimistically, Netflix does have a unique opportunity to revamp their own strategies and behave a bit more like a serious studio, rather than a disruptive tech corporation bent on upsetting everyone’s bottom line, including their own. I would hope that they are able to take note of the branding they are about to acquire. But having seen some of their comments regarding what’s going to happen to HBO Max and its rollout in European territories—which is “nothing is going to change… immediately” and reads as “we are totally canning this at the earliest opportunity but we don’t want our share prices to go through the floor tomorrow”—I am becoming increasingly certain that out of all options available to them, Netflix is going to choose wrong and gleefully drag the entertainment industry into an increasingly uncertain future.

Think about it: they do have an opportunity to lean into what many would like to see bolstered: a comeback of theatrically-present midrange movie, more emphasis on physical media licensing that other streamers have already embraced to an extent and a supercharged investment in their core IPs like DC and others. But the messaging coming out of the Netflix leadership suggests that they don’t want to do any of that and they are simply delaying announcing widespread cutbacks while doubling down on their preexisting ideology of disrupting the status quo, behaving like a data company and generating value rapidly by permanently capturing customers and forcing their competition to follow suit and play catch-up from a less privileged position.

Sadly, the more I look at this situation as it unfolds, the more confident I become that Netflix, having become the largest player in the streaming business, will continue their mission to drive traditional movie business model into the ground, fold WB properties into their streaming offering after stripping it of its assets and continue (1) expanding into emerging markets and (2) degrading their value proposition while strong-arming their customers into ponying up more cash to stay subscribed. If they don’t change course regarding their near-complete zealous opposition of licensing out their in-house productions or allowing physical media releases (which looks like bolting the door to prevent customers from escaping), they will only temporarily stave off hitting their profit ceiling instead of generating new revenue streams.

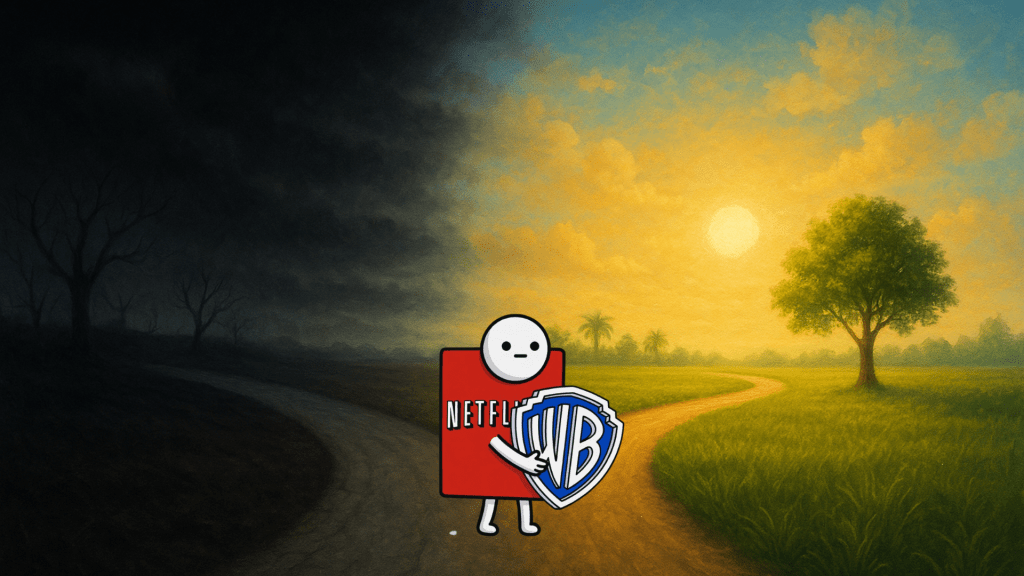

Netflix is facing a fork in the road now. They can use their market position and influence to do something that serves film-goers as a whole and their customers specifically, none of whom are fans of content treadmills and AI slop. All people want is an ability to watch good quality movies and TV shows, see more of their favourite blockbusters on the big screen and have the freedom to engage with these productions in the way they see fit. Most of all, we all want the Netflix subscription to feel valuable. If all they do is mindlessly move fast, break things and disrupt, disrupt, disrupt while raising prices, adding ads and lowering the quality of their offering while also ensuring we feel trapped because there are no other legal alternatives to watch Netflix properties elsewhere, life will simply find a way and piracy will re-emerge and entrench itself in the developed markets, just as it has in markets where a Netflix subscription is considered expensive as it is.

And something tells me that they are about to choose wrong here because their decision-making is driven ideologically. Netflix still sees itself as a disruptor with little regard for the industry it is changing or the legacy is is uprooting. The messaging so far suggests that all they are after are IPs and that the intention is to chain their customer base to themselves before milking them dry.

Leave a comment